price to cash flow from assets formula

But this time data from cash flows statements Cash Flows Statements Cash Flow is the amount of cash or cash equivalent generated consumed by a Company over a given period. To calculate free cash flow all you need to do is turn to a companys financial statements such as the statement of cash flows and use the following FCF formula.

Capital Expenditure Formula Capital Expenditure Accounting And Finance Cash Flow Statement

Cash flow from Investments in Assets is higher at 800000.

. Assets that are short-term and highly liquid investments that can be readily converted into cash and have a low risk of price fluctuation. Project cash flow refers to how cash flows in and out of an organization in regard to a specific existing or potential project. Cash and paper money US Treasury bills.

It is a crucial part of financial planning concerning a companys current or potential projects that dont require a vendor or. Below are some basic principles of project cash flow. What Is the Formula for Calculating Free Cash Flow.

Free Cash Flow Operating Cash Flow. Updated February 18 2022. Ethical analytics again tasked Mr.

A general measure of the companys ability to pay its debts uses operating cash flows and can be calculated as follows. In other words free cash flow is the cash left over. Cash Flow Coverage Ratio Operating Cash Flows Total Debt.

Since all assets are either funded by equity or debt some investors try to disregard the costs of acquiring the assets in the return calculation by adding back interest expense in the formula. There are a few different ways to calculate the cash flow coverage ratio formula depending on which cash flow amounts are to be included. It only makes sense that a higher ratio is more favorable to investors because it shows that the company is more effectively managing its assets to.

Free Cash Flow to firm formula can be represented in the following Three way. The cash left after making investments in capital assets. Project cash flow includes revenue and costs for such a project.

And maintain its capital assets. Unknown to calculate the Cash Flow Per Share CFPS of another company XYZ Pvt. Cash flow from operations.

Couple this with a low-valued share price investors can generally make good investments with companies that have high FCF. It proves to be a prerequisite for analyzing the businesss. The formula below is a simple and the most commonly used formula for levered free cash flow.

Myeducator Business Management Degree Accounting Education Accounting Classes

Financial Ratios Statement Of Cash Flows Accountingcoach Financial Ratio Cash Flow Statement Financial

Cash Flow Formula How To Calculate Cash Flow With Examples

Statement Cash Flows Powerpoint Diagrams Cash Flow Statement Cash Flow Flow

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

How To Calculate Ebitda Cash Flow Statement Financial Analysis Financial Analyst

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Ratios Calculator Double Entry Bookkeeping Cash Flow Statement Cash Flow Learn Accounting

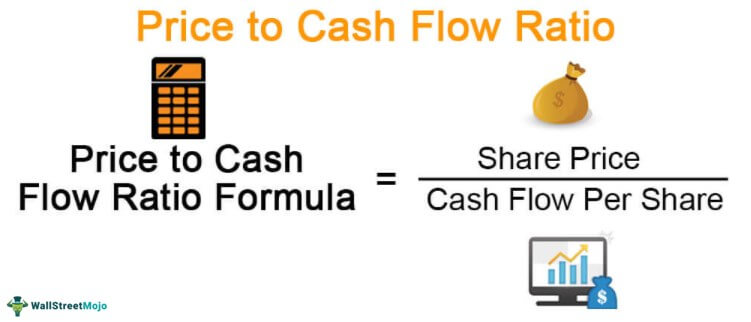

Price To Cash Flow Ratio P Cf Formula And Calculation

Cash Flow From Operating Activities Learn Accounting Accounting Education Cash Flow

Present Value Of Uneven Cash Flows All You Need To Know Cash Flow Financial Life Hacks Financial Management

Formula For Cash Flow Bookkeeping Business Economics Lessons Accounting Education

1 J 23 I E U This Document Kee Cash Flow Statement Sales Revenue Knowing You

Common Financial Accounting Ratios Formulas Financial Analysis Accounting Small Business Resources

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Statement Cash Flow Accounting Basics

Cash Flow From Assets Definition And Formula Bookstime

Cash Flow From Investing Activities Accounting Small Business Accounting Accounting Education

Financial Statements Financial Accounting Economics Lessons Financial Statement